Mortgage Monday Newsletter | February 7th, 2022

Welcome to the Mortgage Monday Newsletter! Each week I will give you 1 Industry Insight, 1 Article to Read, and 3 Quotes to Ponder. I hope you enjoy, and if you do, feel free to pass it along to your friends!

The Fed’s actions remain crucial to monitor in the months to come, as they will play an important role in the direction of the markets and mortgage rates this year.

Note that the Fed has two levers they can pull for tightening the economy – hiking their benchmark Fed Funds Rate and reducing their balance sheet. The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates.

Inflation is running at 7% and we could see that figure move even higher come Thursday’s Consumer Price Index Report, which may add additional pressure to the Bond market.

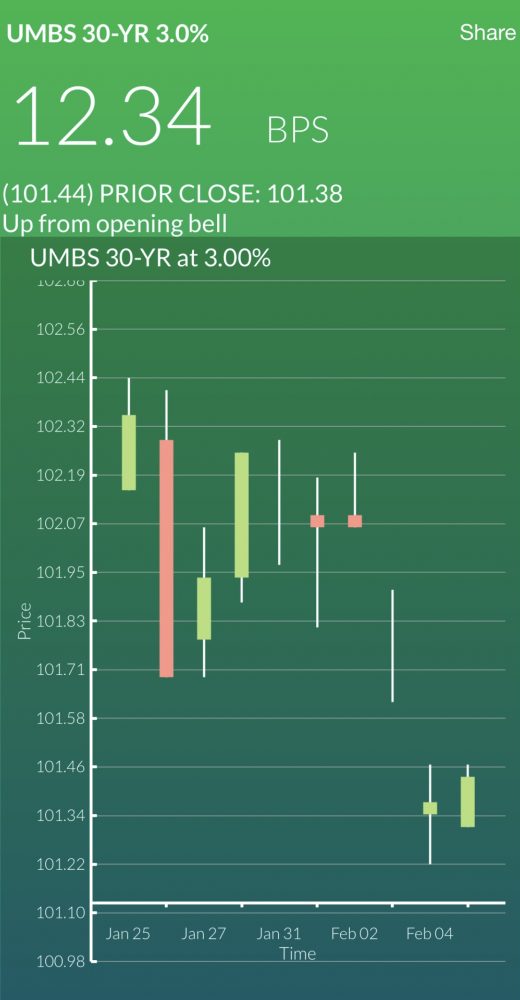

*The chart shows the last 10 days of activity for the 30-year bonds. As of 10:00am this morning, the 30-year bond is up just over 12 basis points. Remember the market is fluid and changing hour to hour, so this is just a snapshot in time.

“The farther backward you can look, the farther forward you can see”

– Winston Churchill

“If you never copy best practices, you’ll have to repeat all the mistakes yourself. If you only copy best practices, you’ll always be one step behind the leaders.”

– James Clear

“Everything works. Some things work better than others. Nothing works forever.”

– Andy McKay